What's Wrong with the Edgeworth Box? (2)

(Part 1)

In Part 1, I explained my view that the Edgeworth Box is used to convince students and other consumers of economic theory that certain social arrangements are inevitable. It's not so important itself as a pedagogical tool, since others have developed and the issues it was meant to settle have long ago become stare decisis. But I think it's worth examining as an economic approach to describing reality.

ECONOMICS AS A HEURISTIC METHOD

The literature of economics is full of definitions of economics; readers are invited to use their preferred search engine and find a few. In recent decades, economics has become much more pugnacious about being a science, with a (a) unique purview over the whole scope of political choice, and (b) comprehensible only to experts in the field. In other words, as research project, economics have taken upon itself pretensions of universal authority, while pre-emptively rejecting the right of any outsider to criticize its positions.

Economists have implied, in doing so, a sort of motivational force-field around themselves, in which the doctrines they preach are impervious to the corrosive self-interest they impute to others. While lawyers are quite open about the fact that they are paid to make arguments about legal doctrine by the expected beneficiaries of that doctrine, economists refuse to accept any such second-guessing. "Markets" are presented as unimpeachably pure, sui generis, and uniquely fit to distribute wealth. Economists may protest that they are merely engaged in abstractions of a reality too complex to present in fuller detail, but people should notice the bizarre implication that public choice is, ultimately, treated as insidious, while the power of business interests is presented as wholesome and self-policing.

So I propose to answer the question: as a research project, what does economics seek to do?

Economics is a process of binding decision-making to accounting. Economics tries to explain and improve decisions by presenting them as causing, and caused by, conditions of scarcity, preference, and accumulation. Humans have agency over their own access to wealth through the ability to produce and accumulate rather than merely hunt and gather. Production and accumulation bring scarcity into the realm of something humans can control, leading to accounting and commerce, hence to the creation of markets. This chain is not meant as a history, but as a heuristic.

The effort to link decisions specifically with certain objective, measurable conditions imposes a lot of simplification-by-average; while individuals are crammed with confusing idiosyncrasies, those particular quirks have effects that are much too small to matter with large groups. Likewise, confusion, doubt, and ignorance will cloud the decisions of individuals, but on average, the crowd is expected to know what it needs to know about objective conditions, and not make consistent errors about the future.

On average, preferences define a well-behaved utility function. On average, expenditures are consistent for categories of goods, and not affected by unit price. And so on. In most cases, these are not just simplistic, but unrealistically simplistic. If you see a mountain from a distance of a meter, you see the grains in the granite and the twisted scrub growing out of cracks; back up 20 kilometers, and you see a massive peak that's generally triangular, probably with pale-lavender at the top and darker chiaroscuro near the base. You do not see a polished cylinder or sphere.

This is justified as producing tolerably good predictions, but it doesn't. It produces tolerably effective political justifications.

THE EDGEWORTH BOX IN CONTEXT

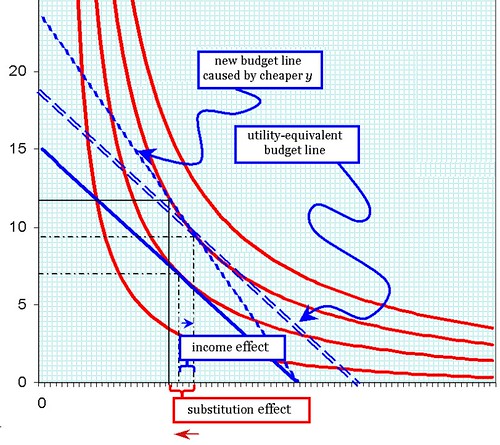

This brings me back to my abuse of the Edgeworth Box. The idea was presented in Edgeworth's book, Mathematical Psychics (PDF; 1881), and later wedded to the concept of the Pareto Optimum: a condition where no one's utility can be enhanced without reducing the utility of another. It's a somewhat nuanced view of conflict, because it implies human relations, even over the very short-run, are neither zero-sum nor yet nonzero-sum; in many cases, there may be distributional problems that can be resolved to everyone's benefit.

At the same time, though, an odd corollary is that, once the market has worked its magic and arbitrage opportunities are exhausted, then social factors are innately hostile to each other. Solidarity plays no role in this; there is no chance for a group of people to get together and enhance their condition in the face of some powerful force, because the Edgeworth Box implies that they're as unified as they will ever be. Likewise, there's no scope for change.

To be clear: I'm not saying the Edgeworth Box needs to explain any change in the endowments of A and B, or suggest that A is really A1, A2,..., An, and these guys just need to get together and drive a harder bargain. That's not for me to say, and I don't think it. But the whole scheme excludes this as a concept.

(I need to pause here and mention that Frances Ysidro Edgeworth himself had a very sophisticated an nuanced idea, which is not closely related to the usual discussions of welfare economics where one is likely to find an EB.)

We can consider different contexts in which the EB applies:

- Trade disputes: here, A and B are "rival" countries. They are knocking out a trade pact, but the pact is very unpopular domestically. Why? Because A and B have at least three rival constituencies, specifically, those who are export-obsessed (workers and some business managers), those who are consumption-obsessed (households and investors), and those who are incentive-obssessed (activists for the environment, human rights, etc., who hope to use the trade pact to mandate some common policy in both countries). While the three groups have massive membership overlap, they also can alter the final outcome.

- Political disputes: acknowledging that the USA is unusual in its bilateral polarization (C.f. most other OECD countries with four political poles, or Japan, with a single pole of varying valence), consider the problem of political disputes between Republicans and Democrats. The absence of common ground is the result of experts and party caucuses seeking a new constituency to recruit for either side, until there are no loose interest groups. The purpose is not some new modus vivendi; it's the permanent eradication of the rival's potential for control. The conflict is asymmetric because the Democratic Party itself consists of a huge number of constituencies that are watchful, if not positively enraged, with each other.

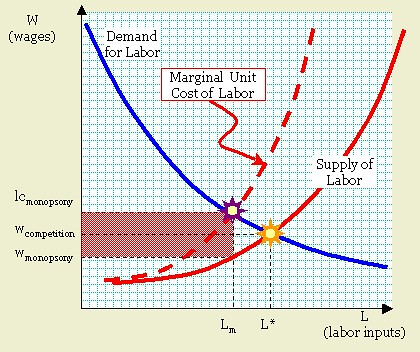

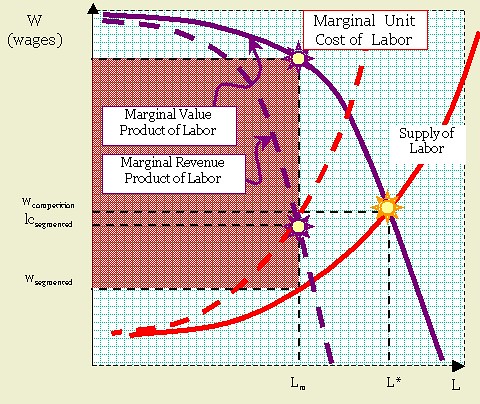

- Labor disputes: Again, mine is a US-centric view, but the lengths to which management will go to prevent unions from being organized not in the realm of economic behavior. Unions have been a successful partner of management in Scandinavian countries and postwar Germany; one can dispute the purity of company unions in Japan, but they are prone to actually showing a flicker of independence. I suspect this has to do with the evolution of the large American industrial corporation into a quasi-sovereign entity, often with its own (de facto) law enforcement and court system,

Labels: anthropology, economics, efficiency, governance, utility

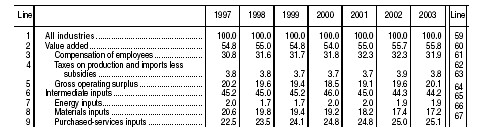

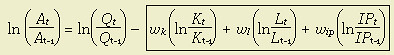

is the annual increase in total factor productivity;

is the annual increase in total factor productivity; is the annual increment in output;

is the annual increment in output; is the annual increment in capital inputs;

is the annual increment in capital inputs; is the annual increment in labor inputs;

is the annual increment in labor inputs; is the annual increment in energy, materials, and business services.

is the annual increment in energy, materials, and business services.