Keynesianism

Some updates and corrections have been made to this essay since posting (16 Aug 2013).

Keynesianism is the casual term used to refer to some economic theories and policy methods that were widely used between 1946 and 1980. These theories are named for John Maynard Keynes (1883-1946), although Keynes was actually the manager of the research group that developed Keynesianism.

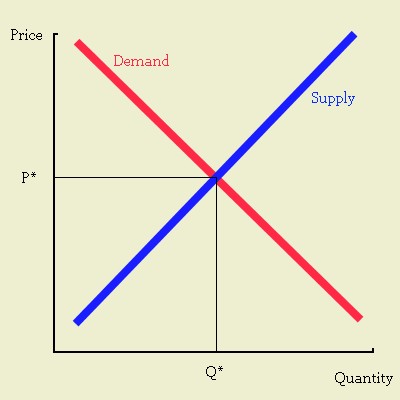

Keynes had already won considerable fame for his work, A Treatise on Money, and had strong ties to intellectual luminaries of the day. Schumpeter's History of Economic Analysis (1954; p.1171) strongly implies that Keynes had already, in a sense, written the General Theory within the covers of the Treatise. I would argue that the General Theory was a milestone in the acceptance of market imperfections, such as sticky prices and corner solutions in factors markets, that had been growing for some time. The crucial departure of Keynesianism can be summarized as "imperfect markets," which meant,

- prices may "never" adjust to reflect the intersection of supply & demand;

- money is not neutral (i.e., disinflation or deflation has a serious impact on economic conditions; the available money supply, accompanied by a distinct market for cash balances, has an impact on real output);

- factor markets, such as for labor, land, and capital, may sometimes not clear;

- state intervention may sometimes cause more good than harm.

However, there are essentially two key features of Keynesian economic policy that were widely adopted everywhere for many years: fiscal policy and monetary policy. Fiscal policy was based on a crucial term of art coined by Keynes, the "theory of effective demand," which acknowledged that supply did not create its own demand, and on occasion it was necessary for the national treasury to step into the breach with deficit spending. This could be achieved with public works spending of various kinds, or it could be accomplished by slashing taxes. Monetary policy consisted of influencing liquidity preferences, or the demand for cash, through shrewd manipulation of interest rates. In later years, it was understood that major national governments had significant, but limited, power to influence interest rates; and the tools for influencing them tended to be fairly blunt.

The other major introduction of Keynes, which was never really reversed, was the idea that the entire economy operated under peculiar rules. Keynes' core idea was that aggregate demand was a linear function of output, but contrary to Say's Law, this relationship is not 1:1. Rather, the marginal propensity to consume (out of production) is somewhat less than 1. Hence, as productive capacity rises, demand for output rises at a somewhat lower pace (Keynes, 1936).

This analysis supplies us with an explanation of the paradox of poverty in the midst of plenty. For the mere existence of an insufficiency of effective demand may, and often will, bring the increase of employment to a standstill before a level of full employ-[p.31]ment has been reached. The insufficiency of effective demand will inhibit the process of production in spite of the fact that the marginal product of labour still exceeds in value the marginal disutility of employment.Prior to Keynes, it was assumed that interest rates were the mechanism that brought saving, and hence, consumption, in line with production. Prior to Keynes, it was believed that, if consumption were to have risen more slowly than productive output, then interest rates would fall, reducing the propensity to save. That would, in turn, push consumption up to what it ought to be. In Chapter 15, Keynes explained that (a) interest rates play a fairly minor role in the decision to save, and in Chapter 17 (b) the connection between the rate of interest and the rate of saving is not real.

Moreover the richer the community, the wider will tend to be the gap between its actual and its potential production; and therefore the more obvious and outrageous the defects of the economic system. For a poor community will be prone to consume by far the greater part of its output, so that a very modest measure of investment will be sufficient to provide full employment; whereas a wealthy community will have to discover much ampler opportunities for investment if the saving propensities of its wealthier members are to be compatible with the employment of its poorer members. If in a potentially wealthy community the inducement to invest is weak, then, in spite of its potential wealth, the working of the principle of effective demand will compel it to reduce its actual output, until, in spite of its potential wealth, it has become so poor that its surplus over its consumption is sufficiently diminished to correspond to the weakness of the inducement to invest.

But worse still. Not only is the marginal propensity to consume [1] weaker in a wealthy community, but, owing to its accumulation of capital being already larger, the opportunities for further investment are less attractive unless the rate of interest falls at a sufficiently rapid rate; which 'brings us to the theory of the rate of interest and to the reasons why it does not automatically fall to the appropriate level, which will occupy Book IV.

Keynes' contribution was therefore the aggregate supply-aggregate demand model of the economy. Almost immediately, his associates, Hicks and Hansen (see below) introduced the IS-LM model, which offered an elegant (if flawed) comprehensive model linking all all of the various states of the economy to interest rates and output.

One minor rebuke of the Keynesian system arises from its reliance on the IS-LM curve. This is more of a pedagogical criticism, since it is not really fundamental to the Keynesian analysis of the economy. The IS-LM has an unfortunate confusion over time; the derivation of the curves themselves don't specify a time horizon, but if the time horizon is long (say, a decade), then the implication is that markets OTHER THAN money and goods are totally passive; and if the time horizon is short (say, a quarter) then there's no role for inflation. On a personal note, I was advised to combine IS-LM and AS-AD, as I did in this 2002 class paper. This article does the same.

Vulgar Keynesianism

In retrospect, Usonian economists and writers on the same have tended to equate Keynesianism with socialism or even outright Communism (examples). It is fairly unusual to find this outside of the United States; for example, his [admiring] biographer, Baron Robert Skidelsky, is not only a Tory member of the House of Lords, he's also associated with many conservative thinktanks in the UK.

There's a long convoluted reason why this is so, which I cannot discuss here and now. But an obvious result has been casual abuse of both the term "Keynesian" and the concepts associated with it. Typically such abuse has been called "Vulgar Keynesianism." The most familiar example of this was the idea of using military spending as a form of economic stimulus. An extremely rare (almost unique, actually) example of a logically consistent anarcho-capitalist, David Stockman, bitterly objected to the idea of military spending to stimulate the economy; he referred to the (mostly military-oriented) space program as "orbiting socialism," and elsewhere in his book, The Triumph of Politics, castigated the Reagan Administration for its "socialistic" invoking of economic stimulus as justification for wasteful, overkill military spending. I will repeat that, with the exception of a tiny number of men, all in the political wilderness, the "free market" conservatives associated with the Reagan Administration were uniformly zealots in favor of military expansion, corporate giveaways, and deficit stimulus of the economy (to achieve irreversible political power).

This is not actually Keynesianism since (a) it loudly repudiated any connection with the intellectual underpinnings of Keynes' General Theory, and (b) consequently ignored the orderly system of analysis, such as the IS-LM curves or the Mundel-Fleming Model of international trade and capital flows, that allow such policies. Obviously, when a political leader runs a deficit while in office, and pleas for fiscal restraint when in opposition, he's just being a politician. "Military Keynesianism" is a defamation of Keynes since it equates utter lack of responsibility with a school of economic thought.

This pattern has continued long after Keynesianism itself was "discredited." Hence, in the 2004 presidential debates, the incumbent declared that he believed "if you raise taxes"—i.e., don't cut them—"in a recession, you'll get a depression." This is an example of a vulgar Keynesian position, since it focuses on the role of effective demand in the business cycle. Otherwise, the allegation that Keynesianism is "socialistic" because it acknowledged a role for the elected authorities in managing business cycles, is silly. Subsequent schools of economics have occasionally availed themselves of this rebuke for polemical reasons, but otherwise offer competing views for how the state ought to manage the economy.

Valid Criticisms of Keynesianism

While much criticism of Keynesianism was silly, some criticism was not. The Achilles Heel of the theory, so to speak, was the difficult transitional phase of the world financial system caused by the collapse of the Bretton Woods System. Some readers will object to this remark, on the grounds that it is excessively sympathetic to a school they consider well and truly "debunked." I advise them to read the essay by Robert E. Lucas & Thomas J. Sargent, "After Keynesian Macroeconomics" (PDF); Lucas & Sargent are, so to speak, the James & John of the Rational Expectations "Revolution."

Lucas & Sargent: There are, therefore, a number of theoretical reasons for believing that the parameters identified as structural by current [viz., "Keynesian"—JRM] macroeconomic methods are not in fact structural. That is, we see no reason to believe that these models have isolated structures which will remain invariant across the class of interventions that figure in contemporary discussions of public policy. Yet the question of whether a particular model is structural is an empirical, not a theoretical, one. If the macroeconomic models had compiled a record of parameter stability, particularly in the face of breaks in the stochastic behavior of the exogenous variables and disturbances, one would be skeptical as to the importance of the prior theoretical objection of the sort we have raised.In other words, Keynesianism was reasonable enough until a massive change in the international monetary system occurred, and an historically unprecedented negative technology shock arrived hard on its heels. Even then, it bears noting, the courtly Lucas and Sargent employ weasel words to jab Keynes: A key element in all Keynesian models, not Keynesian theory. In other words, the Phillips Curve trade-off between unemployment and inflation was a theoretical cul-de-sac stimulated by the times, not Keynes. Heavily modified, as all economic theories are in praxis, Keynesian theory itself could easily have incorporated some form of inflationary expectations.

[...]

Macroeconomic models were subjected to a decisive test in the 1970's. A key element in all Keynesian models is a trade-off between inflation and real output: the higher the inflation rate, the higher is output (or, equivalently, the lower is the rate of unemployment).

Certainly the erratic "fits and starts" character of actual U.S. policy in the 1970's cannot be attributed to recommendations based on Keynesian models, but the inflationary bias on average should, according to these models, have produced the lowest average unemployment for any decade since the 1940's.Again, this is accusing the implementation rather than the actual theory. The "models" to which Lucas refers were developed under conditions prevailing in the 1950's and 1960's, not the peculiar influence of Keynes. They reflected the tendency of professional planners and managers in all circumstances to assume conditions would persist as they had in the past.

A more apt criticism of Keynes lies not in his failure to carry the Neoclassicals' water for them, or to predict the sort of economic Hiroshima caused by the events of 1971-1979. No, the real problem was that Keynes relied too heavily on approximation by rules of thumb. Another problem was that the General Theory offered policy prescriptions that were valid only in conditions where economies were too large and isolated to be affected by international conditions. The Mundell-Fleming Model, mentioned above, resolved this shortcoming, but relied on highly stylized treatment of capital flows.

A final remark to be made is that there is a grievous pitfall in trying to treat the economy as if it were a natural science, like thermodynamics or mechanics. Subsequent theorists have actually attempted to re-direct the field of economics away from its use of equations simulating elastic collisions and other mechanical analogies, to equations that mimic irreversible events in nature, like heat transfer. This idea is just as doomed; as economic activities have their corresponding physical reality (I physically walk to the corner store and physically hand the clerk my money for her carton of milk), there will always be some truth to a physics analogy, but the truth will tend to be trivial.

NOTES:

Research group: Other important researchers included John R. Hicks & Alvin Hansen (co-developers of the IS-LM model), Roy Harrod (developer of the theory of the Keynesian business cycle and growth theories, inter alia), Joan Robinson, Nicholas Kaldor, and Richard Kahn (developer of the crucial concept of the multiplier).

Arguably, the most important single insights were Kahn's multiplier and the Hicks-Harrod IS-LM model.

A Treatise on Money: In 1930, Keynes was still attempting to reconcile the chronic depression in Britain with his [mostly] Neoclassical outlook. Those interested in the evolution of his views can see Giuseppe Fontana's "Keynes on the 'Nature of Economic Thinking': The Principle of Non-Neutrality of Choice and the Principle of Non-Neutrality of Money," American Journal of Economics & Sociology (2001). The book ishttp://www.blogger.com/img/blank.gif two volumes long and opened the door to a lot of future Keynesian notions about money non-neutrality.

1: Timothy T. Hellwig, "," Social Science History Spring 2005 29(1): 107-136. This footnote updated 19 July 2012; the article requires access to Project MUSE, but did not when I wrote this post in early 2007.

ADDITIONAL SOURCES & READING: Alan S. Blinder "Keynesian Economics" Library of Economics & Liberty

BOOKS: Lawrence R. Klein, The Keynesian Revolution, Palgrave Macmillan (1967); Schumpeter, A History of Economic Analysis, Oxford (1954); John M. Keynes, General Theory of Employment, Interest and Money (complete text) Oxford (1936)

Labels: economics, Keynesianism, semantics