CDO Meltdown (2)

(Part 1)

The single most valuable resource on theCDO meltdown is Barnett-Hart (2009); this was a thesis paper submitted for a BA at Harvard University, which received a lot of attention thanks to a favorable cite by Michael Lewis.1 Fittingly, the thesis has won many honors, and it's pretty impressive to read.

A few points introductory to this essay; first, I'm not an expert and this post is my collection of notes on what I regard as helpful or trustworthy sources. The reason why I am writing about this topic is that it's very important to understanding the financial crisis and its concomitant economic catastrophe. Readers are almost certainly not going to share my political views of the matter, but I think some grasp of the mechanics of the crisis will help out in forming their own.

Second, readers interested in an explanation of CDOs are advised to read my first installment or, better still, the first 27 pages of Barnett-Hart's paper.

Additional Background from Barnett-Hart

Most of the CDO market growth took place between 2002 and 2007; a major driving force was the fact that real interest rates were abnormally low, and institutional investors like pension fund managers were required to invest only in AAA-bond assets. CDOs used the waterfall structure to create putatively AAA tranches from pools of assets of far lower rating. In fact, this would have worked except for the fact that the asset pools were (a) not successfully or adequately diversified (i.e.,the assets in the pool were prone to defaulting all at once), and (b) composed of loans of unprecedentedly poor grade (i.e., the loans were made to borrowers who were almost certain to default).

Another reason was that bank holding companies in the USA were now underwriting securities as well as re-lending deposits as loans. Banks could increase their leverage-to-equity ratio by unloading assets to a special purpose entity (SPE; also known as a structured investment vehicle, or SIV), then harvest the returns from the SPE. In a few years, an enormous share of assets and liabilities of the US banking system (including US subsidiaries of foreign banks) were parked in this shadow banking system.

The cash "freed up" by "selling" loans to off-balance sheet zombies (Barnett-Hart called them "brain dead," p.5) was then lent out again. This ruse allowed a large increase in the supply of loanable funds available to the banking system, and spurred a huge boom in housing prices.

About 13% of CDOs issued were created to vacate the balance sheet of a bank.2

The CDOs were exceptionally complex, large entities; they tended to be just under a billion dollars in size, were divided into 7-8 tranches, which usually included one unrated tranche.3 As they became more popular, structured finance came to be the preferred form of collateral (synthetic CDOs).4

CDO performance in the Crisis was highly varied. Quarter of issue, asset type, and underwriter (e.g., Goldman Sachs versus J.P. Morgan) each had an effect that was statistically significant. Bonds incorporated in CDOs generally performed much worse than those that were not (Barnett-Hart, p.12, figure 3). After 2005, synthetic CDOs became the main part of the story, but as of this writing, they remain a comparatively small part of the CDO crisis.5

A Digression on Subordination

A very important part of the CDO boom was the role of ratings and the enhanced return relative to ratings that CDOs offered to investors. CDOs were popular with investors precisely because they were rated much higher than the underlying securities taken separately would have been, had they been rated accurately. Credit rating agencies (CRAs) such as Fitch, Moody's, and Standard & Poor's assumed that the underlying securities were pooled and subordinated in a way that prevented serious losses to investors even if the CRA ratings were excessively optimistic.

One of the indices of "safety" (or unlikelihood of failure) was loan subordination. A typical bank borrows money short-term from depositors and lends it long-term to borrowers. In order to make a return on its capital, it must lend the money at a higher rate than it pays out to depositors. If this spread is large, then the bank can increase its reserves and its capital. In either case, the bank's excess of loan revenues over expenditures (i.e., interest paid in on loans less interest paid out on accounts) protects the depositors from default by borrowers. "Credit enhancement" includes this and other ways of reducing the likely cost of default: [putatively] excessive collateral, and credit default swaps (CDS), or "wrapped securities" (securities insured against loss by a third party) are other ways.

Ratings agencies use a complex formula to pool their estimate of the value of these guarantees; the subordination is supposed to reflect the excess of cash flow over obligations as a percentage, with each tranche in the CDO possessing a different subordination value.

The Effect of Ratings

Earlier, I mentioned that super-senior tranches were supposedly better than AAA, meaning that the waterfall agreement used in CDOs ensured that even market anomalies capable of hitting a AAA security were unlikely to impact a super-senior tranche. This was reflected in the subordination levels for super-seniors: as late as 2007, they were estimated at 22%, compared to <15% for AAA, <10% for AA, and <5% for BBB (Barnett-Hart, p.15, fig.6).6

The ratings agencies did not know how to cope with the huge demand for data that investors (and regulators were now putting on them). The financial system was trained to measure performance by returns relative to risk. High risk investments were supposed to have high rates of return; it wasn't especially impressive if they did. With CDOs, investment houses could churn out high rates of return on low risk investments, with AAA rating. This was the essence of "alpha," or performance of a portfolio adjusted for risk.7

The great majority of CDOs were issued in order to arbitrage the favorable interest and risk imparted by the CDO structure itself. Hence, the CRAs were major instigators of the CDO mania. Barnett-Hart goes so far as refer to the CRAs as "manufacturing AAA CDO securities from collateral with much lower ratings" (p.23), which certainly fits my understanding of the situation.

Sources & Additional Reading

- Peter Lattman "Michael Lewis’s The Big Short? Read the Harvard Thesis Instead!" Deal Journal [blog], The Wall Street Journal (15 March 2010)

- SIFMA spreadsheet (accessed for this post), in worksheet "CDO Purpose." Refers to period 2005-2010, during which 13% of the USD 1.3 trillion in CDO par value issued was for shadow banking. The remaining USSD 1.1 trillion was used for arbitraging the interest premium offered by putatively AAA/AA securities.

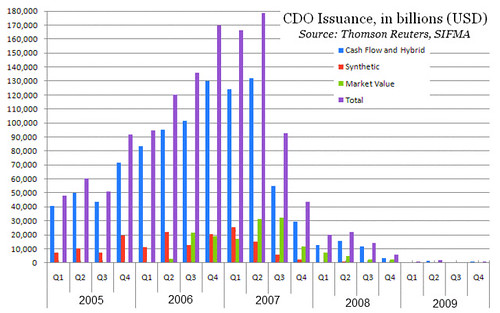

- Barnett-Hart's paper examines 735 CDO transactions with an average value of $829 million each (pp.7-8). This accounts for about half the USD-denominated CDO transactions issued between 1999 and 2007. During this period, USD-denominated transactions accounted for about three-quarters of the total (SIFMA spreadsheet, "Denomination" tab). Unfortunately, the SIFMA data does not cover CDOs before 2000, but this was a minor year in terms of the total volume. After 2008, total CDO issuance plummeted to a tiny fraction of its 2005-2007 rate, especially in the USA.

- According to the SIFMA spreadsheet ("Collateral" tab), structured finance was the collateral in 1% of CDO issuance for 2001; it shot up to 63% in 2005, accounting for 91% of the growth of issuance during this period. The reason, naturally, was a shortage of the other types of collateral. Still, the CDOs included as collateral about a half-trillion USD in "high-yield loans."

Barnett-Hart's paper focuses on asset-backed security (ABS) CDOs, rather than structured finance. By February 2009, about half of these deals had been written off ("Half of all CDOs of ABS failed," Financial Times, 11 February 2009, via Naked Capitalism). This accounted for about USD 105 billion in defaults, out of a total of USD 815 billion (as of 9 Feb 2009; see "Banks’Subprime Market-Related Losses Top $815 Billion," Bloomberg). So basically about a third of ABS CDO failed, and these accounted for 13% of losses in the 2007-2008 Financial Crisis. - An additional USD 24 billion in losses was attributed to synthetic CDOs ("Warning over CDO losses if CIT defaults," Financial Times-14 July 2009). Since our estimate for synthetics comes five months later than the one for total losses and ABS-based CDOs, it's reasonable to assume the figures for the latter two were higher and synthetics performed much better. If not, ABS-based CDOs ($105 B) and synthetics ($24 B) lost $129 B of the total $815 B lost by the top 100 financial institutions worldwide in the Crisis, or about a sixth of the total. Moreover, ABS CDOs losses accounted for 81% of CDO losses overall.

In view of the fact that over half of CDOs issued during the problem period (2005-2007) were synthetic CDOs, this suggests that part of the design principle of the CDO actually worked. - For a prescient critique of the methods used by the CRAs to compute debt subordination, see Xudong An, Yongheng Deng, & Tony Sanders, "Subordination Level as a Predictor of Credit Risk"

Real Estate & Urban Analysis, University of Cambridge (April 2006).

Real Estate & Urban Analysis, University of Cambridge (April 2006). - "Alpha" refers to the rate of return on an investment (or the performance of its manager) relative to the rest of the market. If the manager invests in high risk securities, the return on the portfolio will be likely be higher than otherwise, and such investors will be compensated for greater risk; but higher risk also includes a higher risk of unpleasant surprise. For this reason, people who rate portfolio managers measure "alpha" to compensate for things like the manager's risk preference and the overall behavior of the securities market.

The effect of high ratings on CDO tranches was to permit managers to achieve the illusion of high alphas because they were getting rates of return that exceeded what could have been expected, given the low risk of their portfolios.

Sources & Additional Reading

Efraim Benmelech & Jennifer Dlugosz, "The Credit Rating Crisis"

Anna Katherine Barnett-Hart, "The Story of the CDO Market Meltdown: an Empirical Analysis"

Dr. Michael Wang, Shwn Meei Lee, & Dr. John Ku, "Risks and Risk Management of Collateralized Debt Obligations"

Yves Smith, "The Role of CDOs in Merrill’s Losses (Updated and Expanded Version)," Naked Capitalism (24 October 2007)

Global CDO Issuance, SIFMA (Excel spreadsheet). Outstanding source on CDO statistics.

Labels: economics, finance, regulation, structured finance