Digression on the 1893 Crisis and Currency

This is yet another post that began as a footnote (the same footnote!) to my bigger post on the 1893 Crisis. Most historical crises anywhere have a short summary that most students of history take away, such as "Munich Crisis of 1938: Appeasement is bad," or "Jerusalem, 587 BCE: worship of gods besides Jehovah is bad." The Crisis of 1893 was one of many depressions that hobbled industrial growth during the Gilded Age. As with more recent crises, partisan writers immediately sought to enlist it as evidence for their own dogma, and did so with greater ease after years had passed.

The most familiar account of the 1893 Crisis for most readers will most likely be either Ron Chernow, The House of Morgan, Atlantic Monthly Press (1990), Chapter 5: "Corner" (p.71) or else Robert Sobel, Panic on Wall Street, Truman Talley Books (1988), Chapter 7: "Grover Cleveland and the Ordeal of 1893-95" (p.230). The rumor has it that the Crisis was caused by "debauchery" of the currency by the accumulation of silver reserves courtesy of the Sherman Silver Purchase Act of 1890.

One obvious problem with this claim is that the Sherman Act replaced the Bland-Allison Act of 1878, which also provided for the coinage of silver. Neither bill "watered down" the national reserves with silver. If Chernow wants to make the claim that wild-eyed silverites tampered with the currency shortly before the Crisis, causing a run on reserves, he is stuck with the problem that the silver policy was only slightly changed from 1878, and that the US dollar had been fully convertible to gold since 1879. Another problem is that the gold reserves of the US Treasury and the private-sector fluctuated immensely between 1890 and 1893, as they did before that time. There is no evidence that any of the people who owned American securities at any time between 1889 and 1896 decided to sell them off in bulk because of a fear that the US currency was "debauched" by its coinage of silver.

Sobel's silver monomania leads him to lard every paragraph with some mention of people refusing to accept silver.

During July, as Congress prepared to convene [for a special session called by Pres. Cleveland to repeal the Sherman Silver Purchase Act], news of bank failures and business foreclosures were daily occurrences. The issuance of clearing house receipts once more helped save some institutions, but they could not prevent the fall of others. No one would accept the silver certificates. Anxious Americans, in their flight from the dollar, began to buy pounds sterling with silver... (p.253)Once Sobel has it stuck in his mind that silver coinage is causing a panic, nothing will distract him. If the silver is radioactive as an asset, which Sobel claims, then the fact that the Treasury has a lot of physical coins and silver certificates is not going to alter the supply of high-powered money. There is no causal connection to it causing banking failures or tight money. Sobel constantly alludes to gold "fleeing" the faithless USA for anywhere, implying that the USA was the only country in the world with a public feckless enough to waver on the pure gold (coin) standard. By refusing to examine what was actually going on in other countries, Sobel allows readers to nurture this absurd delusion.

(Sobel's account includes tables showing the monthly prices of major issues during the Crisis. The accompanying text makes no effort to connect these to the currency crisis.)

Sobel and Chernow therefore propagated the claim that J.P. Morgan heroically and single-handedly saved the US Treasury from default by insisting on a bond issue, then ginned up the necessary gold. By 7 February 1895, the New York Subtreasury had less than $9 million on gold coin and, according to J.P. Morgan, there was a check against it for $12 million. Cleveland authorized an issue of $65.1 million in bonds at 4% interest to buy 3.5 million ounces of gold, underwritten by the syndicate Morgan arranged. The influx of gold did not reverse the flow, and by January 1896, Treasury reserves were again at dangerously low levels. Morgan and Cleveland again arranged a much larger bond issue, but this also failed to restore the gold cover. According to Sobel, the defeat of William Jennings Bryan and the 1897 boom in gold were the real cause of economic recovery.

What Really Happened?

First, fair is fair: the Sherman Silver Act did create a significant opportunity for arbitrage by some financial actors. Some financial entities were able to get silver certificates converted to gold, then use the gold to buy assets at an "above-point" rate, and repeat the cycle. Every creditable observer admits that. But the allegation that this was going on because the currency was debauched, or some violation of faith and credit was going on—that is absurd.

The populist movement from 1881 to 1897 was an extremely diverse and complex movement that encompassed conservatives and radicals, dozens of state governments, and dozens of varied reform programs. In the more mainstream accounts of the late 19th century, both the radicals and the repression have been redacted out. In Chernow's account of the crisis, following Sobel, the populists are assumed to be "venomous" and deranged; they all have some mania for silver or (shudder) Greenbacks, and probably want to hang the bankers too. He quotes Anthony Sampson claiming populists "banned bankers" (p.72), which struck me as one of his more egregious feats of fabulism.

Click for larger image

|

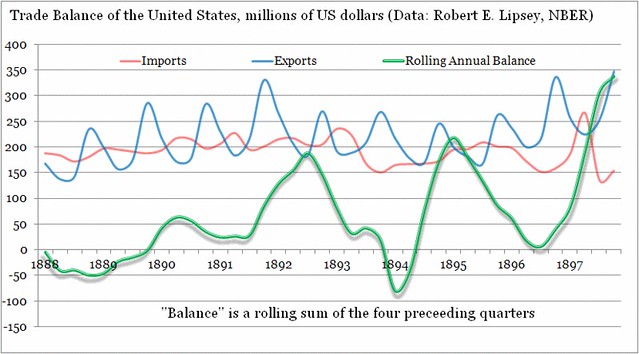

In reality, this period was accompanied by a global depression in trade, during which the balance of trade began a gradual downward slide (masked, of course, by the seasonal fluctuations). During the early years of the Crisis, the boom in exports apparently followed yet another tightening of the tariff rate (McKinley tariff of 1890) during which manufacturers did as they were supposed to—viz., they used the monopoly rents from protected domestic markets to "subsidize" their own exports. But the headwinds of the global economic system were against them and the exports in the second half of 1893 were a disappointment. By 1895, declines in imports had resulted in a soaring trade balance, and probably explains the inflow of gold that J.P. Morgan had been able to take credit for.

This is a fairly conventional reading of the data: the big trade surpluses of 1892 was an intended outcome of industrial policy by the 1889 Congress, while the big trade surplus of 1895 was the result of the gold squeeze.

Additionally, surveys of the banking crisis reveal that the gold withdrawals went to the US interior in response to distressed banks.1 As with a lot of bank runs, the soundness of the banks were not a direct factor in suspension. Some large firms, such as the Philadelpha ξ Reading Railroad were massive and misguided industrial investments; when they became illiquid, it naturally caused a lot of suppliers to suffer strains.

NOTES

- See, for instance, Elmus Wicker, Banking Panics of the Gilded Age, p.54 (and table 4.1, p.55). Wicker (p.58) and Sprague both remark on the fact that most of the banks suspended soon resumed normal operations without being insolvent.

SOURCES ξ ADDITIONAL READING

Charles Conant, A History of Modern Banks of Issue, G.P. Putnam ξ Sons (1909), esp. "The Crisis of 1893," p.523. Vital resource, although chapters on crises require close reading. Very useful to cross-reference with Friedman ξ Schwartz (1963)

Robert Sobel, Panic on Wall Street: a Classic History of America's Financial Disasters, E. P Dutton (1988), "Grover Cleveland and the Ordeal of 1893-1895."

O.M.W. Sprague, History of crises under the national banking system, Volume 5624, United States. National Monetary Commission (1910). Discovered via Friedman ξ Schwartz (1963); totally indispensable resource. Detailed but concise.

Elmus Wicker, Banking Panics of the Gilded Age, Cambridge University Press (2000)

Labels: anthropology, economics, history

0 Comments:

Post a Comment

<< Home