Commercial Banking

Commercial banking is what we usually think of when we speak of banks: an institution that accepts deposits from customers, and loans those deposits to others at a somewhat higher interest rate. There are many varieties of commercial bank, even within the United States, but the core function is to accept deposits and re-lend the money. Banks may also be involved in the expansion of credit.

Loan Banks

An early form of bank in Britain and North America, loan banks issued paper script backed by surety of real estate, merchandise, or personal security.1 During the period 1690-1740, businessmen in France and the English-speaking world made many attempts to introduce paper money, and they kept trying despite some disastrous failures (e.g., John Law's scheme). One particular loan bank scheme set up in Massachusetts (the Land Bank, 1740) had people "subscribe" by identifying land they wished to use as collateral, plus 40 shillings for each £1000 subscribed (that's about £1 per £500 lent). The principal was to be paid in 20 annual installments of 5% each, and 3% interest per annum. The loans were to be repaid in "manufactory notes" or hemp, flax, lumber, bar-iron, cast-iron, etc. Evidently these manufactory notes were supposed to be surrogates for actual English money in Massachusetts.2

While the Massachusetts Land Bank and its local rival, the Silver Bank, were liquidated the next year by the application of the 1719 "Bubble Act", another loan bank in Pennsylvania (1722) successfully introduced paper money through small loans. The land used as security for the loans was to be twice the value of the money lent. It has been noted that these early "banks" were not banks as we understand them, but batches of money.3 However, the loan banks served an essential function of creating the financial instruments that would first be used by the banking industry.

Bank of the United States

This was the first and (until 1863) only federally chartered bank in the US; the first one was chartered between 1791 and 1811, and the second was chartered from 1816 to 1841.4 It was primarily intended to create a system of accounts in a standardized currency (this would be the US dollar, adopted 1793) and make national credit available. In many respects, the BUS served as a central bank, issuing national currency and serving as the national government's banker. However, in other respects it was merely the largest of five commercial banks, distinguished by its unique federal charter, 20% government ownership, and guaranteed federal acceptance of its notes.5 State-chartered banks regarded the BUS as pernicious competition; opposition to it and its successor, the 2nd BUS, became an early sectional issue.

The BUS did play a pioneering, at least in the Usonian experience, in monetary policy. The market for debt was not yet highly developed, and it was not really possible to influence the prevailing rate of interest, but the BUS could "inject" liquidity into the securities market by occasionally becoming involved. Politically, this was explosive, as the bank's opponents argued it was a dangerous plaything of economically useless speculators (and therefore was accused of either causing bubbles and panics, or else—by palliating them—coddling speculation).6

Commercial Banking to 1913

Banking has always been heavily regulated; it's just that the regulations are difficult to compare across epochs. The notion that the 19th century was a golden age of laissez-faire is not really accurate. To begin with, while regulations of business were a lot less complicated in the 19th century, they were usually in more sweeping terms: prohibition of branching, or extremely large reserve requirements. Requirements to redeem obligations in specie (gold or silver coin) were such that perfectly legitimate institutions, guilty only of smallness, were vulnerable to being put out of business through peremptory demands on reserves.7 While banks did issue their own banknotes until 1913, the federal government began to impose capital adequacy requirements in 1863; these were made progressively more complex to prevent evasion, and to regulate more sophisticated securities markets.8 Issuance of notes, before this, was regulated by state laws and banks were regarded by state legislatures as quasi-public entities, especially in the Mid-Atlantic: state legislatures [sometimes] authorized purchases of bank stock for newly-chartered banks, gave special recognition to banks they had chartered, and expected the banks to serve the interests of their respective states. Needless to say, each state had a different regulatory regime, and the regulations changed very often. After 1864, national banking laws effectively eliminated state-chartered banknotes, and regulated federally-chartered banknotes.

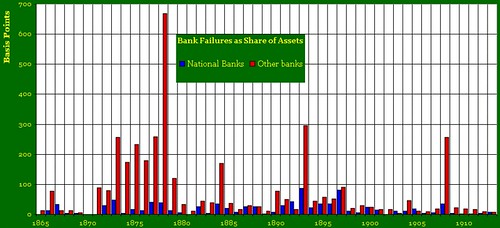

Data from EH.net Click for larger image; units in basis points |

The creation of the Federal Reserve System (1913) meant an authentic central bank governed by policy discretion and countercyclical monetary policy.9 Unfortunately, there would be at least two major depressions before the Fed became effective.

Commercial Banking, 1913-present

The enterprise of investment banking and securities dealing expanded rapidly in importance in the early 20th century. Partly this reflected the growth of publicly traded corporations; prior to the Gilded Age, securities trading involved a fairly small number of stable firms. While securities and underwriting are enterprises dating back to the 16th century in Europe, they remained extremely small in scope in the US until the early 20th century.10 Underwriting was mainly the purview of merchant banks until the capital markets became fairly large and mature, in the early 20th century. Commercial banks tended to dabble in a range of financial operations as they became prominently lucrative, and by 1929, were heavily involved in both marketing stocks from the secondary market (speculating and hedging) and new issues of stock (underwriting). Banks developed notoriety for opaque blendings of these enterprises: use of assets to buy huge tranches of stocks, thereby stimulating the market briefly in order to expedite an initial public offering (IPO), then withdrawing from the market once the offering was sold, or else using the bank assets to "play" the stock market, buy outstanding shares in the inflated markets, and use the profits to manage a leveraged buyout of the bank on behalf of management.11

In the years sandwiching the abolition of the Glass-Steagall Act, a lot of papers were published at the Federal Reserve or the Department of the Treasury that sounded as if they'd been written by commercial bank spokesmen.12 Mostly these are methodologically flawed; for example, the whole point of conflict of interest between dealing securities (on the one hand) and underwriting them (on the other), or underwriting securities and lending money to the same firms, is not that the company involved is liable to do more poorly than the market, but rather, that it has such an unfair advantage that there is a generalized misallocation of resources. When a company is not allowed to fail because it would be too expensive for its sponsoring bank to let it; and if the sponsoring bank has the ability to pump gigantic sums of money into the enterprise until it's viable (perhaps because it has market dominance), then that's a deadweight loss for the economy. This is, after all, the main rationale for why command economies are unsuccessful.

In the event, financial institutions of the 1920's were Petri dishes of conflicted interest.13 While the Glass-Steagall Act was also accompanied by deposit insurance, which has played an important role in the stability of commercial banks, the G-S period of banking was a period of unusual banking stability. It may be said to have ended with the Garn-St. Germain Bill of 1982, which created a dangerous loophole for thrifts.

The Glass-Steagall Act of 1933 was an early New Deal measure. As with any public policy, it suffered from several flaws; much of the early New Deal itself was unguided by any compelling sense of direction. However, it transformed banks back into quasi-public institutions. Commercial banks were staid, cautious, and transparent. They seldom failed, and they were not big innovators.

Thrifts

Thrifts (Savings and Loan Associations) are a separate category of retail bank. Initially they were non-profit societies that took deposits and made loans. They require a separate entry.

NOTES:

- Davis Rich Dewey, The Financial History of the United States, 8th ed., Longmans, Green 🙵 Co. (1922), "Loan banks," p.24. Link goes to complete text online.

- England and Scotland were merged politically in 1707 after being under identical monarchs for 106 years. The Royal Bank of Scotland and the Bank of Scotland issued pound notes identical in value to the English pound for centuries. The North American colonies had been created as private ventures under patent to the Crown, and were officially subordinate to it (rather than Parliament); the colonies during this period had their own respective currencies, and sometimes more than one (e.g., Connecticut had its own pound and dollar). The provinces of Canada mostly used banknotes from the southern colonies (chiefly Massachusetts, which first issued them in 1690), and after 1812, from their own respective provincial banks. Montreal's banks furnished most of the early dollars used in British North America, but the Maritime provinces also issued their currency, denominated in pounds. See James Powell, A History of the Canadian Dollar, Bank of Canada (2006?), "British Colonies in North America: The Early Years (pre-1841)." Link is to complete text online.

- For example, Theodore Julius Grayson, Leaders and Periods of American Finance, Ayer Publishing (1969), p.14.

- David Cowen, "The First Bank of the United States," EH.Net Encyclopedia, ed. by Robert Whaples (16 March 2008)

- Robert Wright, "Origins of Commercial Banking in the United States, 1781-1830". EH.Net Encyclopedia, (26 March 2008). By 1799, the number of commercial banks in the US had risen to 33; at the time of its charter, however, the BUS was much larger than the four other banks combined (measured by capital). In 1796, the US government divested much of its stock to raise money for debts outstanding to the BUS.

- Robert Sobel, Panic on Wall Street: A History of America's Financial Disasters, Beard Books (1988; link goes to '99 edition), "William Duer and the Panic of 1792"

- For example, most banks issued their own banknotes prior to the 1863-1864 National Banking Acts. In New England, banks were extremely small and had no branches; banknotes from "country banks" were difficult to redeem. In 1818, the Suffolk Bank was chartered in Boston and devised an arrangement with other banks whereby it would handle redemption of most notes. In this way, the Suffolk Bank could send agents to banks in rural areas with huge amounts of banknotes from that bank, and demand specie redemption at once. Since the banks could not meet the demand, they were compelled to join the Suffolk redemption scheme, which of course imposed its own regulatory regime. See Howard Bodenhorn, "Antebellum Banking in the United States," under the entry for the "Suffolk System." Here, of course, the Suffolk System was a monopoly arrangement with kickbacks to big banks upon whom the Suffolk Bank relied.

There is a famous period of "free banking" in the USA (1837-1863), when only state-chartered banks existed. In some states, for a time, it was possible to form savings associations under very minimal regulations. See Gerald P. Dwyer Jr., "Wildcat Banking, Banking Panics, and Free Banking in the United States" (PDF), Economic Review, Federal Reserve Bank of Atlanta (Dec 1996). However, what free banks could actually do was very highly restricted. - Richard Grossman "US Banking History, Civil War to World War II"; mostly addresses regulation.

- "Countercyclical" means that the policy taken by the authorities (either in the money supply or aggregate demand) is in opposition to, and therefore counteracts, the [business] cycle. For an explanation of the general concept, see Satyajit Chatterjee, "Why Does Countercyclical Monetary Policy Matter?" (PDF), Business Review Federal Reserve Bank of Philidephia (1Q 2001). On the effectiveness of the Fed in preventing or causing depressions, see Milton Friedman 🙵 Anna J. Schwartz, A Monetary History of the United States, 1867-1990, Princeton (1971), Chapter 7. While there is ample criticism of F🙵S's thesis, this part of it is not very controversial.

The caption to the chart includes a link to the EH.net article with the source data, but I used an Excel spreadsheet to determine the rates of banking failure.

The Federal Reserve Act of 1913 was drafted by Rep. Carter Glass (R-VA), who later developed the Glass-Steagall Act (1933). See James McAfee, "'These Gambling Activities': Carter Glass and the battle to rein in the banking industry" The Region Federal Reserve Bank of Minneapolis (March 2000). - Getting a grip on the comparative size of securities dealing is extremely difficult. Most histories like to cite some amazingly early date, such as the founding of the Amsterdam Stock Exchange in 1531, or the Buttonwood Agreement that created the New York Stock Exchange (sort of) in 1792. Sobel (1988; see note 6) mentions several manias that gripped New York City or the nation, but these either (a) involved very small numbers of people, or (b) were a transcient fad, like the "scriptomania" of 1792. When an activity like securities dealering to the general public becomes economically significant, it tends to come under regulation. This first took place in Kansas ("A Brief History of Securities Regulation," State of Wisconsin Department of Financial Institutions). The SEC was created in 1933, and established minimum national standards for the first time in US history.

- Merchant banks are actually the oldest types of banks; underwriting was first carried out in an orderly fashion by them. See L M Bhole, Financial Institutions and Markets: Structure, Growth and Innovations, Tata McGraw-Hill (2004), p.13.28ff

- An especially cheeky example is Assistant Secretary for Financial Institutions Richard S. Carnell's remarks at the Women in Housing and Finance Symposium (9 Feb '96); here is an example of someone supposed to be in charge of regulating financial institutions, fulminating at the sheer stupidity of regulations entirely. Anti-regulation articles at the Federal Reserve include David P. Ely 🙵 Kenneth J. Robinson, "How Might Financial Institutions React to Glass–Steagall Repeal? Evidence from the Stock Market" (PDF), Financial Industry Studies, Dallas Fed (Sep 1998), p.1 (PDF-page4); Luca Benzoni and Carola Schenone, "Conflict of Interest and Certification in the U.S. IPO Market" (PDF), Federal Reserve Bank of Chicago (Sep 2007). Note that Benzoni 🙵 Schenone's review of the literature includes no papers critical of the repeal of Glass-Steagall. Finally, there is this bio of Carter Glass at the Federal Reserve Bank of Minneapolis—a singular case of remorseless character assassination by an institution that normally is highly indulgent of reactionary tendencies. (Like most Southern politicians of the early 20th century, Carter Glass was in favor of segregation; while this has no relevance to the Glass-Steagall Act, the Minneapolis Fed resorted to trumpeting it violently in order to demonize the act itself).

- On evidence of such conflicts, one scarcely knows where to begin. Ron Chernow's The House of Morgan, p.174ff; Sobel's Panic on Wall Street, Chapters 8-11; Burton Malkiel, A Random Walk Down Wall Street, W. W. Norton 🙵 Company (2004), p.183ff; for non-Usonian examples, see Stefano Battilossi, "Corporate Governance, Moral Hazard and Conflict of Interest in Italian Universal Banking, 1914-1933" (PDF) University of Madrid (Feb 2003).

SOURCES 🙵 ADDITIONAL READING:

EH.Net Encyclopedia

- Howard Bodenhorn, "Antebellum Banking in the United States" (26 March 2008)

- Richard Grossman "US Banking History, Civil War to World War II" (16 March 2008)

- Elmus Wicker "Banking Panics in the US: 1873-1933" (5 Sep 2001)

- Robert Wright, "Origins of Commercial Banking in the United States, 1781-1830" (28 March 2008)

0 Comments:

Post a Comment

<< Home